As an alternative, the telephone business helps make the deal totally themselves. You are able to install PayViaPhone’s application in the Bing Gamble Store or App Shop. Next, you’ll need to perform a merchant account in order generate in initial deposit. After that you can put a popular shell out-by-cellular casino system to own smooth and you can difficulty-totally free dumps, which will be put into your own mobile phone expenses. Particular shell out by mobile websites confirm money thru Text messages because of a great third-party commission processor chip.

Recommend the new consider just before deposit

- Specific financial institutions may allow you to fool around with an excellent QR code on your own financial app.

- Other payment versions, such currency sales otherwise international monitors, may not be accepted to possess cellular put at the lender.

- Think of, you might like to generate on your own a fundamental take a look at away from a different account and you may put you to definitely into the on the internet checking account.

- Hold on to your own seek a bit until the fund had been truthfully wired into the checking account.This may along with assist clear any questions the financial institution can get query concerning your credibility of your take a look at.

- The company charge you a tiny payment to own this, nevertheless the percentage probably is not as much as fuel and you can parking manage rates to take it to your jail personally.

Be sure to confirm where you would like the amount of money transferred. When you have numerous bank accounts with a lender, you will be able to pick your own appeal away from a drop-off menu. Some banks and you can credit unions make it a cellular put of someone else’s look at (also known as a third-team look at), while some exclude it (and Bank out of The united states and you can U.S. Bank). Of a lot financial institutions render cellular look at put, along with Friend Bank, Bank out of The united states, Investment You to, Pursue, Citibank, Come across, PNC Financial, U.S. Lender, and you will Wells Fargo.

It requires Expanded to own Fund hitting Your bank account

Or even need local casino expenses to seem on the bank account/cards (but do not head him or her getting on the cellular phone expenses!), you may be obligated to adopt it as in initial deposit solution. Shell out from the cell phone in the online casinos is frequently always build deposits. Unlike a checking account or charge card, you may make in initial deposit utilizing your newest label credit. The key advantageous asset of this procedure is that you don’t you would like a credit card otherwise a bank checking account to help you play from the an online local casino. Far more convenient than dollars and you will monitors — money is deducted right from your organization bank account.

Be sure you know the terms of the newest deposit, have them written down, and simply believe in initial deposit discover here when you are purchased to find the automobile. Leaving a deposit offers a danger of a primary losses, but sometimes it can be to your own advantage to set-aside the new auto. To own in initial deposit to be smart, you must be really certain you are ready to purchase the brand new car.

Depending on the financial, fund deposited via cellular cheque deposit is generally readily available as soon since the next day. Banks has financing availableness formula you to regulate how much time it needs to possess an excellent cheque to clear. Specific banking companies, for example, will make the main cheque readily available straight away, with the rest offered next business day.

As mentioned over, just because your put a check during your bank’s mobile app doesn’t imply you could put from view. Whether or not their mobile deposit appears to go off rather than a good hitch, it will be a good idea to keep the brand new paper take a look at just after they clears, and if there’s a problem later on. To own a mobile look at put becoming canned, it should be rightly endorsed. For individuals who’re not following regulations—signing they and you will composing specific kind of “to have cellular put simply” on the rear—then there’s a chance the brand new put would be denied. You’d need to redeposit the new look at, that will add to the wishing time until they clears your membership.

Next, go into the desired put number and you may follow the for the-monitor recommendations doing your order. As it’s an excellent prepaid service means, you acquired’t manage to withdraw to your Paysafecard just yet. Users can create Paysafecard membership and you will greatest upwards their balances which have discount coupons. However for today, online casinos wear’t service Paysafecard distributions. This can be an excellent prepaid service approach that enables you to put in the gambling enterprises. A life threatening advantage of Paysafecard is that people wear’t must hook bank accounts or handmade cards to make use of they.

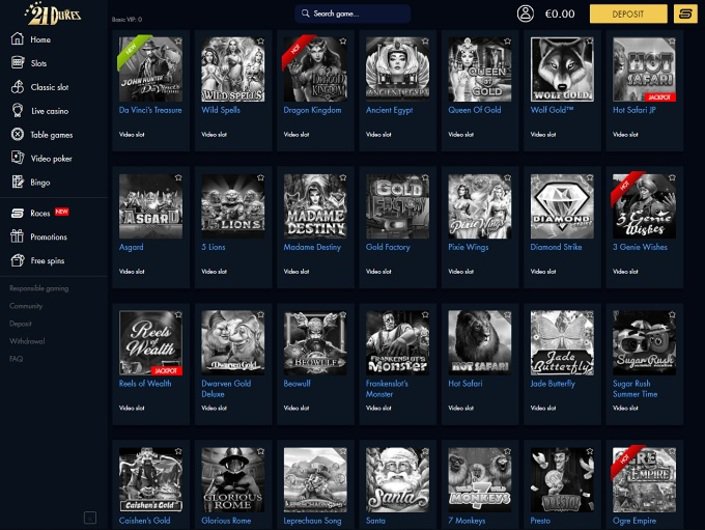

The brand new ‘Newly opened’ loss, meanwhile, will reveal the brand new of these web sites. Speaking of often just getting started and could has a number of juicy offers to make use of, even though they might not have a score yet. The fresh ‘All’ loss near to it does set up a full directory of web sites, whenever selected. Making a good PIN Debit put by the send, find out a check otherwise money purchase and be sure in order to through the inmate identity/ID and you may business identity. AdvancePayTo build an AdvancePay percentage by the send, make out a otherwise money buy payable to “AdvancePay Provider Service” and be sure to incorporate your account amount. You are enjoying Rates and you will Words & Conditions relevant to a state other than your geographical area.

When you go to enter your view, the brand new app will show you the maximum amount you can deposit. If you want to deposit an amount that is over the new restrict, see our branches otherwise ATMs. Make sure you keep your sign in a secure area until you see the complete put amount listed in your account’s previous/current transactions. Opinion every piece of information you’ve submitted to make sure it’s precise. Fill in your take a look at and wait for verification to find out if it’s acknowledged.

Eligibility for PNC Remote Deposit is actually at the mercy of financial recognition. PNC Remote Put does away with need to transportation paper monitors to help you the newest part and you may makes use of investigation signal to PNC. The computer suppresses several dumps of a, due to copy identification, and offers pages that have a couple of degrees of security, to simply help give you peace of mind. Be mindful of so it local casino, as it might present pay by the cellular phone expenses deposit choices in the the long term, therefore it is a more attractive selection for mobile players. Bitcoin, Ethereum, or any other cryptocurrencies are another age of digital currency you to definitely specific local casino operators are turning to. But not, All of us gambling enterprises largely end providing these percentage steps due it in the-county regulations.

The simplest way to see if your financial business also offers mobile cheque deposit should be to cheque your banking software or name the lending company or borrowing from the bank relationship. There are lots of causes you could potentially make use of your bank’s cellular cheque put function, you start with comfort. Deposit cheques with your smart phone may be a lot more obtainable and you will less time-consuming than just riding so you can a branch otherwise Atm.

Mobile consider placing lets a buyers to store hard work from the deposit a remotely on the mobile phone due to a good bank’s mobile software. To have defense grounds, of many banks restrict the quantity you could potentially deposit remotely. See just what their lender’s every day and you may month-to-month mobile deposit restrictions is, next concur that your look at number is within the individuals constraints.